How to Calculate Customer Lifetime Value for Vape Shops

Estimated 0 min read

How can you measure your vape shop’s success? There are leading indicators you can define to help you do exactly that. The only complexity is defining those that actually measure tell you whether or not your business is doing well.

One of the most important leading indicators you can choose to follow is the average customer lifetime value (CLV). CLV is the among of net profit that a single customer contributes to your vape shop throughout the customer’s existence as a client.

CLV allows you to understand exactly how important a single client is to your business and how hard you should work to keep them. The average customer lifetime value would tell you how important (in monetary terms) is your average customer, and if it turns out that they aren’t very important to the running of your business, then you’ll be able to apply strategies to make their CLV greater.

In other words:

The greater your average customer lifetime value is, the better your business will do. With specific customer lifetime value you’ll also be able to tell which customers you should concentrate on and why you should be focusing on them instead of others.

TABLE OF CONTENTS

Why Is Customer Lifetime Value Important?

How to Calculate Lifetime Value

The Customer Lifetime Value Formula

__________________________________________________

Why Is Customer Lifetime Value Important?

It gives you an evidence-based look into the benefit of acquiring a new customer, keeping an existing one, or even letting a low-value customer getaway.

Unfortunately:

The harsh truth is that not all customers are worth the same, and defining your target CLV will also help you define more important, broader aspects of your business like the business model and customer retention strategy.

It would be easy to say that you should only try to focus on high-value customers, but what if your business model caters to low-value customers by focusing on large consumer volumes of clients that make small purchases from time to time? Perhaps the volume of clients alone is enough for you to sustain the business, even though the lifetime value per customer isn’t considered high.

Likewise:

It could also be that your customers make only a small purchase every 6 or 12 months, but throughout their lifetime that value adds up to much more than a single purchase every year. Making them high-value customers.

The point is:

There are many ways to look at CLV and many ways to use it to run a successful vape shop. It’s up to you to decide who the right type of customer is for your specific business goals. The one thing that is certain is that knowing your customer’s lifetime value is extremely important in the effort to do so.

Perhaps the most important reason why you should make an effort to calculate the average customer lifetime value is that it will help you understand the frequency with which a customer makes a purchase and by what time in their cycle as a customer they’ll stop making them.

How to Calculate Lifetime Value

As you can see from the introduction above, the concept of customer lifetime value can take many different forms. In fact, different companies will choose different ways of calculating lifetime value according to their overall business goals.

In this article, we will focus on the average customer lifetime value, as we believe that this is the most flexible and widely applicable version of lifetime value. But before we can take a deeper look into the customer lifetime value formula and how to determine CLV, we first have to understand the foundations behind it.

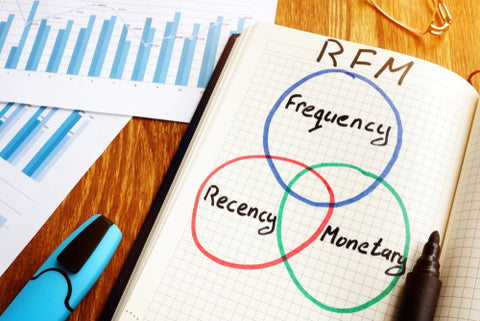

The RFM analysis is a marketing technique used to rank a group of customers based on three main elements; Recency, Frequency, and Monetary Value. Here’s how these three elements are defined:

- Recency: This tells you when the last time was that a customer made a purchase.

- Frequency: The frequency with which a customer makes a purchase from your vape shop within a specific time period. The larger the frequency, the larger the chances they will make another transaction.

- Monetary Value: This is the amount of money a customer has spent on your vape shop during the same time period specified above.

While RFM doesn’t actually tell you how to calculate lifetime value, it does give you the foundational bases to understand it when you do. What you’ll need to do now is give a score to each of your customers depending on their performance in each of the elements in the RFM technique.

It’s up to you to decide what makes a valuable customer in recency, frequency, and monetary value. For example, it could be that a high-scoring customer in recency is one that has made a purchase in the last two months, while a low-scoring customer is one that hasn’t made a purchase in 12 months. The same concept applies to scoring frequency and monetary value. Although it might be a lot more simple to know which customers are valuable in the case of monetary value just by looking at their spending.

You can also use these three variables to segment your existing customer into high, medium, and low-value consumers.

The Customer Lifetime Value Formula

The customer lifetime value formula is actually very simple when expressed as a math equation:

Customer Lifetime Value = Customer Value x Average Customer Lifespan

But the question remains, where do you get the values for the variables that you in the customer lifetime value formula from?

The average customer lifespan (ACL) is the average number of days a customer remains active. But in order to have am ore accurate calculation, you’ll need to get the average ACL for ALL your customers. In other words, it is the average time a customer is active from the moment they make their first purchase to the moment they make their last. The magic formula to getting the average customer lifespan is:

Average Customer Lifespan = The Sum of All Customer Lifespans / Total # of Customers

On the other hand:

The customer value is calculated by multiplying the average order value by the purchase frequency:

Customer Value = Average Order Value x Purchase Frequency

Purchase frequency will vary depending on the customer you are evaluating, so we suggest you use an average purchase frequency. It would be even more accurate to segment your customers as described above and use each segment’s average purchase frequency and calculate a customer value for each of them.